Loan Apps To Borrow Money In Nigeria with Low Interest Rate

Loan Apps To Borrow Money In Nigeria with Low Interest Rate. Have you heard about smartphone applications for accessing fast loans? Do you want to know any of the best applications for quick loans?

When do you need to satisfy any emergency financial obligations?

It's always been a stressful thing to get loans. Either of you have to

If you belong to a cooperative association or have a bank account, you are

Loan-seeking from.

So there's no limit to this. You need a lot of formalities.

To go through which credits are sourced for personal needs and minor specifications

Professional companies by going by the usual ways that we are used to.

But, uh,

There are start-ups in the financial world, all due to innovations.

The technology sector was developed with the sole objective of providing loans to

Masters of small businesses and people. And the part of it that is interesting is

Any loan applications supply you with loans within 24 hours of sending them.

Application for yours.

In order to help you satisfy emergency needs or company needs, they are there to offer quick loans.

So I'm going to share with you 11 of the best fast loan applications in this article.

Loan Apps To Borrow Money In Nigeria with Low Interest Rate

1. OKash

Okash is a sub-unit of Opay and is one

of the best apps for quick loans. Though Okash has always been on the

Opay app, it has now moved to become a standalone app on Google

play store.

Okash began operations in kenya in 2018 before spreading out to Nigeria.

To apply for a loan with Okash app, you need to first download the

mobile app from Google playstore, open the app and sign up with your

phone number, fill in your personal information after log in and then

apply for the loan. This is how simple it is to apply for loan using

Okash.

Key Features of OKash Loan

- Okash gives up to N50,000 maximum for a start (the more you lend and return the more your limit increase)

- You can apply for loan with your credit card

- Okash offers a pay-back plan of 91 days to 365 days (this is a flexible payment considering the days)

- Offers yearly interest rate of 36.5% to 360%

Download Link: Click Here

2. Kwikmoney (MIGO)

Kwikmoney is now a quick loan app

has been rebranded to Migo. Migo provides an easy portal for consumers to be able to

Apply via their website for loans.

Visit the Migo loan portal and access your phone to get a loan at Migo

Digit, which will ask you for the amount of loan you are

Request and then enter your bank information in order to conveniently deposit the

Of the loan.

It is also easy to use and does not require you to download any app. On the website, all operations will be carried out.

Migo also provides an easier means of getting a loan, as straightforward as just getting a loan.

The same way you repay credit with your sim, dial a code.

On MTN, GLO and Etisalat, you can apply for a loan loan by dialing *564# or by dialing *554*561# for Airtel.

Main KwikMoney (Okash) Features

The apps provide two versatile ways to receive loans through USSD codes and their website.

Migo does not have a smartphone version, it has a responsive application website.

To get loans from Migo, you do not need a promise.

3. RenMoney

RenMoney is just another quick-loan tool. Under the license of a microfinance bank, the service was created.

Until there was a change in name in 2013, RenMoney was previously known as Rencredits.

Until its name was changed, RenMoney was previously known as Rencredits. Along with other banking services, such as insurance services, it provides a fair lending program.

You will save the money and even have an extra interest paid to the capital investment with RenMoney investment.

To apply for a RenMoney loan, you need to be between the age of

25-59 years of age, have a verifiable and legitimate source of revenue, have a verifiable source of income, have a

Finally, the bank account must live or work in the towns they run.

(and they are practically working in Lagos at the time of writing this post)

Main Functionalities

Loan offerings of up to N4 million naira

The median term for RenMoney loans is 12 months.

An interest rate of 35.76 percent is provided

RenMoney has an interface that lets you access its resources.

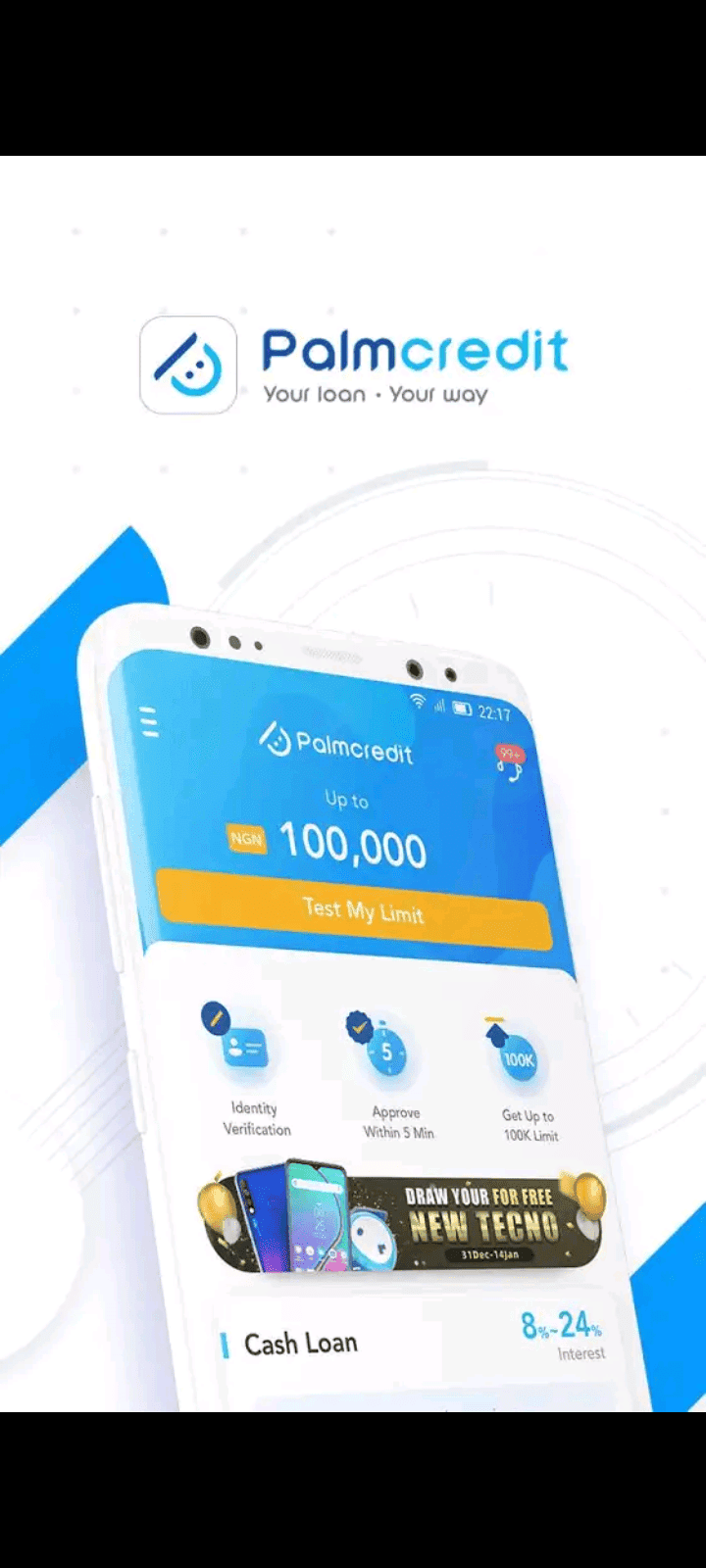

4. Palmcredit

Palmcredit is basically an android app

that provides loan to users of the app. This, unlike other loan applications, is

They have a website on this platform through which you can request

for loans.

Apart from you downloading the app, there is no other way to request

loans from Palmcredit which makes their service not versatile enough for

Users who do not have a phone with an android.

Palmcredit loan is limited to 18 years and above and the loan volume is under the range of N2,000 to N100,000 naira.

Palmcredit Key Features

Must be 18 years or above

Loan limit range from NGN 2000 to NGN100,000

The Loan period is from 91 days and 180 days

Loan interest is between 14 percent and 24 percent while the annual loan interest is between 48 percent to 56 percent

Application is all through a mobile app

For most phones, Responsive Mobile app

Link to Download: Click Here

5. Paylater (Carbon)

Paylater, also referred to as carbon, or

Getcarbon is a credit app that makes it easy for you to regulate your

Finance by offering loans for individuals and small ones with a few clicks

In addition to making it easy to spend your money online, company owners

Carbon is one of the firms in FINTECH that helps you to save money from all the financial transfers you make as well.

In addition to offering loans for citizens, the PayLater network also provides

Enables you to make recharge card transfers, bills like your NEPA

Bill and other equipment.

This is one of the characteristics that in its own way makes Paylater special.

Main Functionalities

To use their services, PayLater has a smartphone app for

Provides immediate credit without collateral

Enables you to receive a discount for multiple purchases by using your wallet

Loan repayment can be made through carbon wallet, debit card, quickteller and direct transfer.

Offers loans of up to NGN1 million naira or Ksh 30,000 million naira or Ksh 30,000

For now it provides its services in Nigeria and Kenya.

Off Off

6. Branch loan

Branch loan is a fast online loan platform that offers users of the Branch loan app instant loans.

Like the other credit software mentioned here, Branch does not need any

Securities to get loans. All you need to get a branch loan is your own.

Facebook account or phone number, bank verification number and bank verification number

Number in an account.

The branch uses your phone data, SMS messages, your information,

Along with the operation of your deposit, bank account to determine either

Whether or not to give you a loan.

Main Functionalities

Provides loans from as little as NGN1,000 to NGN200,000

The branch proposes a loan term of 4 weeks to 15 months.

The interest rate is between 14% and 28%, with monthly interest varying from 1% to 20%.

It offers versatile options for repaying loans. Loans can be paid by debit card at a GT bank branch with cash.

Branch has an affiliation scheme in which if you refer a mate, you receive a bonus

Branch lending programs are limited to Lagos.

Connect Download: Click Here

7. Quickcheck

One of the best applications for Quickcheck is

As the name means, get easy loans. In reality, it has been able to

Rationalize what their name actually is.

When your account is accepted within 24 hours, you will get a loan, which is awesome if you ask me.

The first step to getting started with the processing of loans on Quickcheck

Sign in with your Facebook account to download their mobile app

Details and fill in the detail required in the box given.

Quickcheck does not only provide small business loans for small businesses,

People in search of funds before the next payday to keep surviving.

Let's look at the main features of Quickcheck with all these being listed.

Main Functionalities

Offers users instant loans to

It has a smartphone app that enables access to all loan facilities.

Both the software and the webapp(a much more sophisticated website) have a stunning and user-friendly gui.

For a period of 30 months, Quickcheck provides loans of NGN10,000 to new customers.

Connect Download: Click Here

8. Aella Credit

Aella Credit is a strategic all-in-one,

A remedy for people and small businesses alike. The software includes the

Things and services; deposits, savings, wage expenses,

Peer-to-peer donation and micro-insurance programme.

The goods sold by Aella Credit vary from other loan applications.

As Aella credit is not just a loan app, but a total financial business,

A selection of investment solutions and merchandise.

That said, Aella credit items can be accessed via their applications.

They have all the android applications for smartphone devices. The edition for iOS

The software is yet to be released.

The following are Aella's main characteristics.

Main Functionalities

Provides loan sizes from NGN 1,000 to NGN 4,000,000

Loan conditions for in-network customers vary from 1 to 2 months to 2 to 6 months.

Interest rates range from 4% to 30% depending on the characteristics of the applicant.

Aella is actually only available on android devices and this is a de-merit on their own part

Download Link: Click Here

9. Fair Money

Fairmoney is another best fast loan applications

for users interested in taking small loans for short terms. The debts are

They are not acceptable for company owners, but for wage earners trying to get

Their pay before the month's end.

Fairmoney provides a fast, secure and free mobile app that carries out its loan operation.

It provides a loan of up to NGN500,000 without collateral and no special processing charge for the loans attached.

FairMoney also provides airtime recharge and payment of bill providers on their platform, in addition to handing out loans.

Main Functionalities

Provides instant loans from as little as NGN 1,500 to NGN 500,000

The loan term is 180 days long.

It gives an interest rate ranging from 10% to 30%.

Has an affiliate program through which you can earn a program whenever you refer a friend

Offers a flexible repayment of loans through installment

Connection to Download: Click Here (Android)

Download Link: Click Here (Android)

10. Soko Loan

Another app that can't be Sokoloan is

When listing the best fast loan applications, overlooked. Mainly, the loan app is

Nothing more was developed except to supply people with loans.

Soko loan is a product of Soko lending, a microfinance agency,

Group Limited in order to expand financial possibilities for

The Bad People.

The Soko loan is made up of passionate individuals who are not only after the

Benefit but are seeking an aim among the financial problems to solve

Fewer rights.

First of all, you need to download to get access to this chance.

You then fill in the requisite information with the Sokoloan app and get your

Loan to your account given your account has been authorised.

Main Functionalities

On Android devices, the Sokoloan app is currently available.

Offers loans in the range of NGN5,000 and NGN100,000

4.5 percent to 34 percent interest rate

Offers a loan duration term of 7 days to 190 days

Connect Download: Click Here

Download Link: Click Here

11. KiaKia Loan

Kiakia is a mobile webapp that provides instant individual and small business loans. The word KiaKia is a yoruba which can be translated as “quickly, quickly”.

This is what the branding of their business stands for. It would be unfair to not mention Kiakia loan app on the list of apps for quick loans.

The unique aspect of KiaKia is that it is a two-way system. It a platform for users to get loans and also for users to give loans.

You can either be the recipient of a loan or the donor of the loan. This is an interesting financial solution that makes it scalable because the higher the numbers of givers, the more people KiaKia can provide loans for.

So for the scalable model, KiaKia uses big data, machine learning, psychometry algorithm for credit risk management and credit scoring.

This algorithm helps them reduce the risk of the finance solution products they are offering.

Key Features

- It is a two-way system that allows users to take loans or give loans to others.

- The app uses big data and machine learning algorithm for credit scoring

- It has a user-friendly interface for users

- Offers a paperless solution. It does not require documents and credentials

- Uses a chatbot to assist in using their services which asks for your email address

12. Jumia One

Jumia One is a product of Jumia. It offers you instant access to micro-loans which can be accessed using Jumia One loan app.

Because of the branding of its parent firm, Jumia, Jumia One is one of the trusted loan apps in Nigeria.

You must download the mobile app to get a loan from Jumia One,

You sign up and login, have all the details you need, wait for some

Time for your appeal to be accepted.

It is a top-notch online lending app, but it still has its own challenges, such as accessing the service only from a smartphone app.

Main Functionalities

Has a mobile app through which it coordinates it service

It offers instant loan

Obtaining of loans does not require any collateral

Download Link: Click Here

Download Link: Click Here

Which is the Best Loan Apps for Fast Loans?

The short answer to this question is “it depends”. And this is the truth. The right loan applications depend on the requirements, your needs, and the length of the loans you are applying for.

It could be RenMoney for another Okash for one person. It depends on the amount you want to finance, the interest rate you are prepared to pay, the length of time you want stretched out the repayment, etc.

That said, I wrote the key features of each app, including the de-merit of some of them, to help you make the right choice.

I hope this can be enough to help you make a better decision appropriate for your company or individual needs.

Let us list some positive features to look for in a loan app to shed some light on the items to look for.

Are you eligible for credit on the loan app?

What is the highest amount of loan on the app you can apply for?

What is the interest rate for them and the length of the loan?

Will it have a form of adjustable repayment?

Does it ultimately fit your needs?

Loan Apps To Borrow Money In Nigeria with Low Interest Rate

Click here to like our Facebook Page and here to join our Telegram Channel for more free unlimited Internet tricks and tutorials.

Comments